Covid-19 Communications Connections from the Ontario Government

The following is information on how to deal with COVID-19 while being open for business.

There are various topics and links to information that will help you navigate your business, employees and to remain safe through the COVID -19 Pandemic.

The following is information the Ontario government and is supplied to us through the COVID-19 Communications Connections.

Ontario Fruit and Vegetable Growers Association

https://www.ofvga.org/covid-19-worker-resources

Connecting Ontario residents with the proper resources to answer questions and help find solutions to their problem concerning COVID-19

https://connectability.ca/covid-19/

Ontario COVID-19 Help for Businesses in Ontario

https://covid-19.ontario.ca/covid-19-help-businesses-ontario

Ontario Guidance for Small Business and Employers

https://www.ontario.ca/page/screening-covid-19-guidance-employers

Ontario Government Resources for Small Business Recovery

https://covid-19.ontario.ca/small-business-recovery-resources

Ontario Latest Information about COVID-19

September 22, 2021 – PROOF OF VACCINATION REQUIREMENTS!

For more information from the Ministry of Health:

https://www.hpph.ca/en/news/understanding-encouraged-as-proof-of-vaccination-takes-effect.aspx

Ontario enters Step 1 of reopening on Friday, June 11… 3 days earlier than expected!

Overview

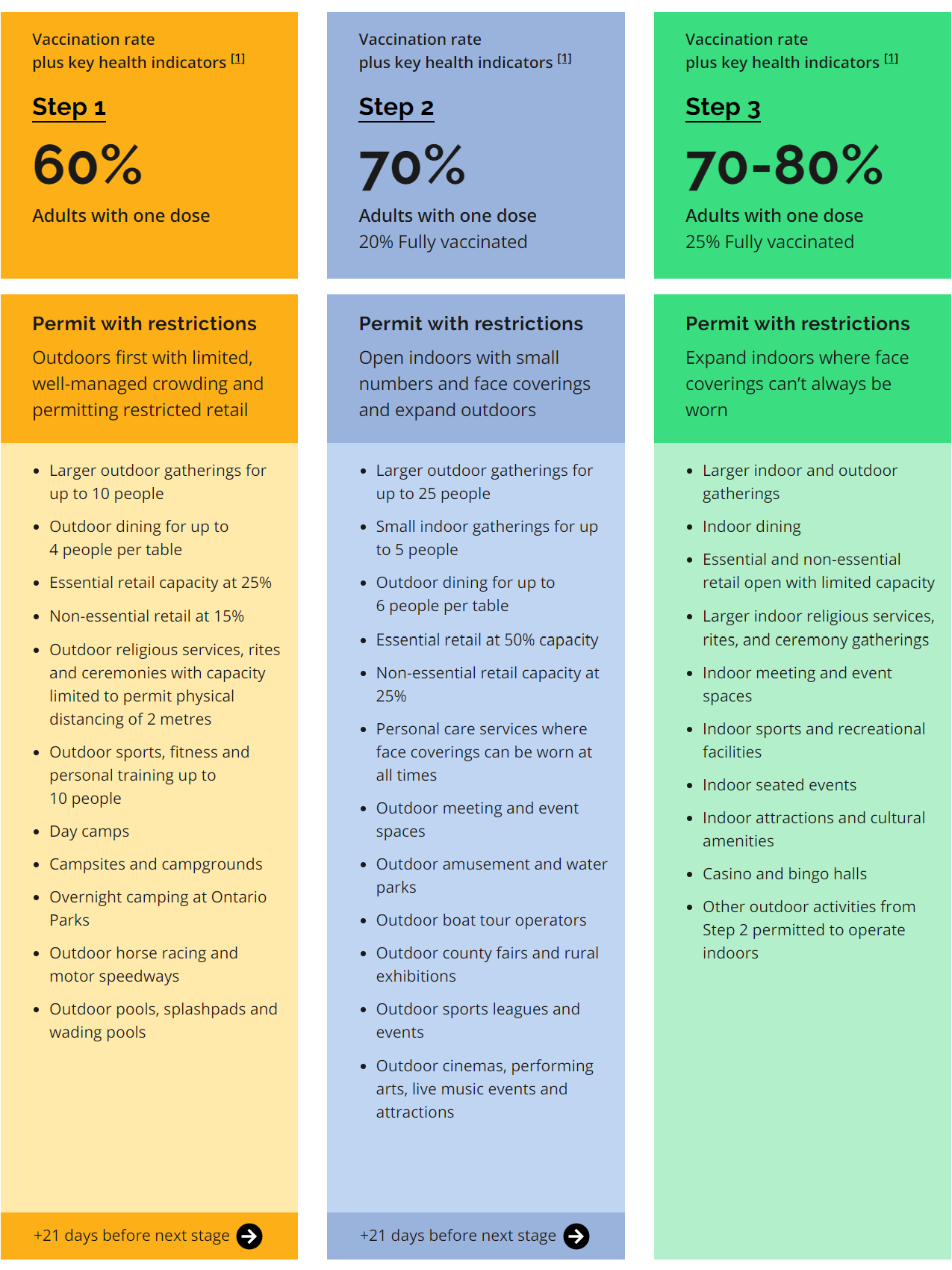

The Roadmap to Reopen is a three-step plan to safely and cautiously reopen the province and gradually lift public health measures.

The plan is based on:

- the provincewide vaccination rate

- improvements in key public health and health care indicators

Until we move to Step 1 of the roadmap, we must all continue to follow the rules and public health measures under the provincewide emergency brake.

Guiding principles

Step 1 – beginning Friday, June 11, 2021

An initial focus on resuming outdoor activities with smaller crowds where the risk of transmission is lower, and permitting limited retail with restrictions. This includes:

- outdoor gatherings of up to 10 people

- outdoor dining with up to four people per table

- non-essential retail at 15% capacity

Step 2

Further expanding outdoor activities and resuming limited indoor services with small numbers of people and with face coverings being worn. This includes:

- outdoor gatherings of up to 25 people

- outdoor sports and leagues

- overnight camps

- personal care services where face coverings can be worn and with capacity limits

- indoor religious services, rites or ceremony gatherings at 25% capacity

Step 3

Expanding access to indoor settings, with restrictions, including where there are larger numbers of people and where face coverings can’t always be worn. This includes:

- indoor sports and recreational fitness

- indoor dining

- museums, art galleries and libraries

- casinos and bingo halls with capacity limits

Moving through the steps

The province will remain at each step for at least 21 days to evaluate any impacts on key public health and health system indicators. It can take up to two weeks for covid 19 vaccinations to offer protection against the virus.

The province will remain in Step 1 for at least 21 days to evaluate any impacts on key public health and health system indicators.

If at the end of the 21 days the province has met the following vaccination thresholds, and there are continued improvements in other key public health and health system indicators, the province may move to the next step of the roadmap:

- Step 1: 60% of adults vaccinated with one dose

- Step 2: 70% of adults vaccinated with one dose and 20% vaccinated with two doses

- Step 3: 70 to 80% of adults vaccinated with one dose and 25% vaccinated with two doses

________________________________________________________________________________________________________